SPY ETF: Understanding the S&P 500's Most Popular Tracking Fund

SPY ETF: Understanding the S&P 500's Most Popular Tracking Fund

The SPDR S&P 500 ETF Trust (SPY) is one of the most well-known and heavily traded exchange-traded funds (ETFs) in the world. But what exactly is it, and why is it so popular? This article will break down the SPY ETF, exploring its purpose, the factors that influence its price, and some alternatives you might want to consider.

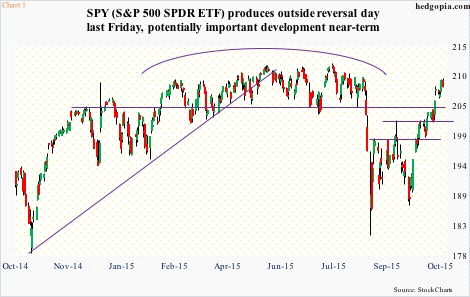

S&P 500 ETF (SPY) Update: Market Catalysts Waning

What is the SPY ETF?

The SPY ETF is designed to track the performance of the S&P 500 index. The S&P 500 represents 500 of the largest publicly traded companies in the United States, making it a broad benchmark for the overall U.S. stock market. By investing in SPY, you're essentially buying a single security that mirrors the collective performance of these 500 companies.

Launched in 1993, SPY was one of the first ETFs and has since become a cornerstone of many investment portfolios. Its accessibility and liquidity make it a popular choice for both individual and institutional investors.

Factors Influencing SPY's Price

Several factors can influence the price of the SPY ETF, as it directly reflects the performance of the underlying S&P 500 index:

- Economic Conditions: Overall economic health, including GDP growth, employment rates, and inflation, significantly impacts company earnings and, consequently, the stock market.

- Interest Rates: Changes in interest rates set by the Federal Reserve can affect borrowing costs for companies and consumer spending, influencing stock valuations.

- Company Earnings: The collective earnings reports of the 500 companies within the S&P 500 drive the index's performance. Positive earnings surprises generally lead to price increases, while negative surprises can cause declines.

- Geopolitical Events: Global events, such as trade wars, political instability, and international conflicts, can create market volatility and impact investor sentiment.

- Investor Sentiment: Market psychology and investor confidence play a crucial role. Bullish sentiment can drive prices higher, while bearish sentiment can lead to sell-offs.

Alternatives to SPY

While SPY is a popular choice, several alternative ETFs offer similar exposure to the S&P 500. Some investors might prefer these alternatives due to lower expense ratios or slightly different tracking methodologies.

- VOO (Vanguard S&P 500 ETF): VOO is a low-cost alternative to SPY, offering nearly identical exposure to the S&P 500 with a lower expense ratio.

- IVV (iShares Core S&P 500 ETF): Similar to VOO, IVV provides broad exposure to the S&P 500 at a competitive expense ratio.

The choice between SPY and its alternatives often comes down to personal preference and cost considerations. While the differences in performance are typically minimal, the lower expense ratios of VOO and IVV can result in slightly higher returns over the long term.

Key Takeaways

The SPY ETF is a powerful tool for investors seeking broad exposure to the U.S. stock market. By understanding what it is, the factors that influence its price, and the available alternatives, you can make informed decisions about whether SPY is the right investment for your portfolio. Its high liquidity and tight bid-ask spreads make it a favorite among traders and long-term investors alike.

References

- SPDR S&P 500 ETF (SPY) - Yahoo Finance

- SPY ETF Stock Price & Overview - Stock Analysis

- SPY SPDR S&P 500 ETF TRUST - USD DIS - Sector SPDRs

- SPDR S&P 500 (SPY) Latest Prices, Charts & News - Nasdaq

- SPY - SPDR S&P 500 ETF Trust Stock Price and Quote - Finviz

- SPY Performance Metrics & Technical Analysis | RankMyTrade.com

- SPY ETF Has Ruled For Decades, But Is It Still The Best Bet? - Benzinga

- Investors Flock To Lower-Cost Vanguard S&P 500 ETF: Is It Time To Switch From SPY To VOO? - Benzinga

- SPY: The Original S&P 500® ETF | SPDR®

- S&P 500 ETF (SPY) Update: Market Catalysts Waning - See It Market